The information in this blog is for general informational purposes only and does not constitute legal advice. Consult a qualified attorney for advice on your specific situation. We make no guarantees about the accuracy or completeness of the information provided. Reliance on any information in this blog is at your own risk.

Ontario’s Employment Standards Act, 2000 (ESA) sets hard limits on daily and weekly hours, overtime pay, and rest periods. Ministry of Labour audits regularly uncover record-keeping gaps, invalid excess-hours agreements, and unpaid overtime—exposures that can trigger back-pay orders, administrative penalties, and public “name-and-shame” postings. Whether you run a tech start-up, a manufacturing plant, or a professional-services firm, now is the moment to stress-test your scheduling practices against ESA requirements.

Core Hour-of-Work Rules

Daily & Weekly Maximums

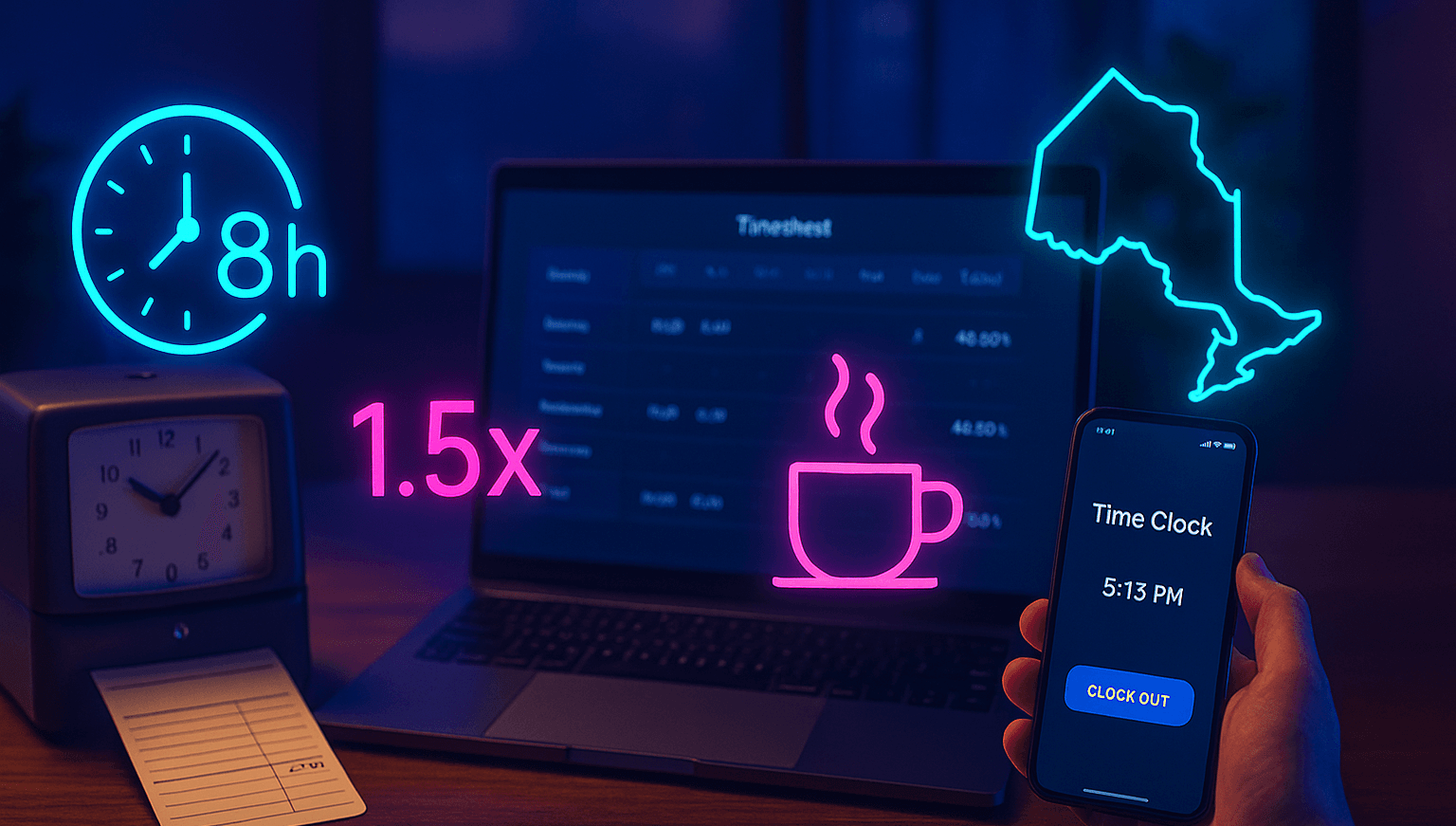

- 8 hours per day (or the established regular workday, if longer)

– - 48 hours per week

Exception: You may exceed either cap only with (a) a written excess-hours agreement signed by the employee and (b) advance Director of Employment Standards approval. Without both, even “voluntary” extra hours violate the ESA.

Overtime Threshold

Non-managerial employees earn overtime at 1.5 × the regular rate after 44 hours in a workweek. Job titles do not matter—actual duties determine “managerial” status.

Mandatory Breaks & Rest

- Eating period: A 30-minute unpaid break after five consecutive hours. Two shorter breaks totalling 30 minutes are legal only if in writing.

– - Daily rest: 11 consecutive hours between shifts.

– - Weekly rest: 24 consecutive hours every seven days (or 48 hours in a 14-day span).

Frequent Compliance Pitfalls

| Pitfall | Why It’s a Problem | ESA Fix |

| No time tracking for remote staff | Hidden overtime liability | Use digital punch-in/out apps with audit trails |

| Fancy “Director” titles for non-managerial roles | Overtime exemption invalid | Reclassify or pay overtime |

| Rolling averaging agreements | Must have fixed start/stop dates & employee consent | Renew every 1–2 years; file with MOL |

| Compressed workweeks (4 × 10h days) without approvals | Daily hours > 8 trigger OT | Secure excess-hours approval or pay overtime |

| Assuming coffee breaks are unpaid | Paid if employee isn’t fully relieved | Clarify and track each break |

Understanding Averaging & Excess-Hours Agreements

Averaging lets you spread hours over 2–4 weeks to avoid overtime spikes (e.g., 88 hours over two weeks). Requirements:

- Written agreement, signed and retained for three years.

- Fixed term (max two years unless collective agreement).

- Director approval if averaging beyond four weeks.

Excess-hours agreements allow work beyond 48 hours per week. They never exempt overtime pay—they only lift the 48-hour weekly ceiling.

Sector-Specific Nuances

- IT Professionals – Since 2022, many IT roles once exempt now qualify for overtime unless they perform “systems analysis” duties.

– - Construction & Road Building – Special daily overtime triggers; consult Reg. 285/01.

– - Healthcare & Emergency – Can override 11-hour rest in bona fide emergencies but must provide “substituted time off” later.

Never assume an exemption—verify in ESA Reg. 285/01 or obtain legal advice.

Record-Keeping Must-Haves (3-Year Retention)

- Daily start/stop times, including unpaid breaks > 30 minutes

– - Total daily & weekly hours worked

– - Signed copies of excess-hours and averaging agreements

– - Overtime, vacation, and public-holiday pay calculations

– - Proof of ESA information-sheet delivery

Digital systems are acceptable if data are accurate, unalterable, and printable on demand.

Practical Compliance Strategies

- Deploy automated time-tracking—geo-stamped mobile apps for field teams; single sign-on punch-ins for office/remote staff.

– - Audit “managerial” roles—compare duties to ESA exemption criteria; fix mis-classifications before audits.

– - Renew agreements annually—avoid “indefinite” averaging or excess-hours setups that can be struck down.

– - Offer lieu time carefully—written consent required; banked hours must be taken within 3 months (or 12 with written agreement).

– - Educate supervisors—many overtime errors stem from ad-hoc schedule tweaks and undocumented break skips.

Penalties for Non-Compliance

- Wage-recovery orders—back pay plus 10 % administrative fee.

– - Administrative monetary penalties (AMPs)—up to $1,500 per offence, escalating for repeats.

– - Compliance orders—mandatory process fixes under tight deadlines.

– - Public posting—repeat violators named on the Ministry website, damaging reputation and recruitment.

Self-Audit Checklist

- Employment contracts cite “standard hours: 40 per week” and include OT clause.

– - Remote staff log hours in the same system as on-site employees.

– - Written excess-hours and averaging agreements on file for each affected employee.

– - Break schedules ensure ≥ 30 unpaid minutes after five hours.

– - Daily records show 11-hour rest between shifts unless emergency override documented.

– - All “managers” have real budget, hiring, and disciplinary authority.

– - Payroll reports show OT premiums at 1.5 × after 44 hours.

If you tick “no” anywhere, risk is lurking.

How AMAR-VR LAW Can Help

- Comprehensive ESA audits of policies, time-tracking, and job classifications

– - Custom excess-hours & averaging agreements aligned with Director-approval requirements

– - Manager training on scheduling, documentation, and remote-work compliance

– - Representation during Ministry of Labour inspections and appeals

– - Policy design for lieu time, flexible scheduling, and electronic timekeeping

Our goal: embed compliance so thoroughly that audits become painless.

Conclusion

Hours-of-work compliance isn’t just about paying overtime; it’s about structured scheduling, airtight records, and written agreements that withstand Ministry scrutiny. By aligning your practices with ESA caps, documenting approvals, and training supervisors, you protect both your workforce and your balance sheet.

Unsure whether your organisation passes the ESA stress test? Contact us today for a consultation for an audit or policy overhaul—because the best time to fix compliance is before an inspector knocks.

Frequently Asked Questions (FAQs)

- When does overtime pay apply in Ontario?

–

Overtime pay applies when a non-managerial employee works more than 44 hours in a single workweek. The employee must be paid at one and a half times their regular rate for each hour worked beyond that threshold. The employee’s job duties, not their job title, determine whether they qualify for overtime.

– - Can employees work more than 48 hours a week?

–

Employees can work more than 48 hours per week only if they have signed an excess-hours agreement with the employer and if the employer has received prior approval from the Director of Employment Standards. Without both the written agreement and the Director’s approval, any work beyond 48 hours violates the Employment Standards Act, even if the employee agrees to work the extra time.

– - Do compressed workweeks automatically avoid overtime obligations?

–

Compressed workweeks, such as working four ten-hour days instead of five eight-hour days, do not automatically exempt employers from paying overtime. Unless a valid excess-hours agreement and Director approval are in place, any hours worked beyond eight in a single day still require overtime pay, even if the total weekly hours appear reasonable.

– - What breaks are employers required to provide under the Employment Standards Act?

–

Employers must provide employees with an unpaid eating period of at least 30 minutes after no more than five consecutive hours of work. While employers may offer additional rest or coffee breaks, these are not mandatory under the Act. However, if breaks are paid or the employee is not fully relieved of duties, the time counts toward hours worked.

– - What records are employers required to keep to comply with the Employment Standards Act?

–

Employers must maintain detailed records for at least three years. These records must include daily start and end times, total daily and weekly hours worked, copies of any written overtime, averaging, or excess-hours agreements, and all calculations related to overtime and vacation pay. Digital record-keeping systems are acceptable as long as they maintain a verifiable audit trail.